REAL ESTATE INVESTMENT

Development Ventures LLC pursues real estate investment opportunities with select private investors and partners. As project sponsor, developer and investor, the firm delivers select property developments through private equity real estate funds.

We focus on tactical investments that typically include niche properties requiring physical improvement or a high degree of enhancement, new development or re-development.

Development Ventures (DV) delivers on each aspect of a property development’s life-cycle, including directly undertaking the project sourcing, feasibility, funding, acquisition, investment management, development, design, management and project delivery oversight from initial operations through stabilization, and finally the disposal/sale of the property or respective asset unit share.

DV seeks to deliver the highest risk-adjusted returns for our stakeholders while bringing added value to the community by improving the built environment around it through investment in the creation of sustainable and strong economic real estate assets.

Our Approach

At Development Ventures, our real estate investment approach is focused and consistent.

DV’s experienced team sources, underwrites, and manages the complete investment and development process from acquisition on through disposition.

Investments are managed through DV’s real estate private equity funds. Our funds are closed-ended vehicles with a 3-5 year investment horizon. We target superior risk-adjusted returns across our value-added and opportunistic real estate investments in select niche properties, through the implementation of our full life-cycle development and investment strategy.

Upon acquiring the select asset, DV applies its comprehensive active management skills to optimize the investment. This includes addressing any physical, operating and capital structure issues. We further secure and enhance each investment's highest potential with our direct engagement through the project's development, design and delivery process.

Once the asset is improved with the development work completed and the project's operations stabilized, DV will seek to maximise stakeholder value by either (1) disposing of the asset by selling it at a strategic phase in the property cycle to core investors looking for a strong stable investment, or (2) strategically growing its lucrative portfolio of revenue generating properties if deemed more attractive than an exit sale.

Investors & Partners

Our Investors and venture partners form a valuable part of our strategy. We optimize our capital structure to create synergies and alignment that maximise the venture’s success and value-add for all our stakeholders.

NICHE Strategy: Market, Asset, Service

The NICHE element stands at the core of our business and real estate investment strategy and serves as catalyst for synergies across our select market, asset, and service.

We target niche markets that are traditionally ignored by larger organizations. As such markets are small yet valuable in comparison to broader mainstream markets, Development Ventures has unique opportunity to successfully fill in this gap in the market by the way of its structure and its strategic approach.

NICHE Market:

- We operate in focused, targetable subsets of a market sector.

- We delivers our Investors exposure to an alternative asset class within a niche market segment that offers high risk-adjusted return potential with low market correlation as part of a well-diversified portfolio.

- We serve Consumers that are looking for exclusiveness and specific requirements not satisfied by standard assets.

NICHE Asset:

- Our assets serve the needs of the specific demographic segment (business or individual) as a narrowly defined group.

- Our niche assets and investment properties are so specialized, there are relatively few to no competitors.

NICHE Service:

Our services are focused to address a specific asset class, market and customer.

'The development ventures way'

Focus on niche real estate in exclusive locations around the globe requiring physical improvement and enhancement, new development or re-development

Source and deliver real estate developments with the potential to yield high risk-adjusted returns through our targeted and synergetic investment approach

Comprehensive active management to optimize investment and direct engagement throughout the complete development lifecycle to further enhance the investment’s potential

Investment Opportunities

Our competitive edge and differentiation can be attributed to our comprehensive expertise and global view with a strategic focus, delivering on niche luxury real estate developments across exclusive growing markets around the world. Each project we undertake is meticulously analyzed to ensure its development and financial success in line with the strategic focus and growth of the firm.

Development Ventures' upcoming real estate investment fund embraces DV's niche strategy with a focus on developing a select group of luxury boutique hotels in exclusive global locations offering great growth potential.

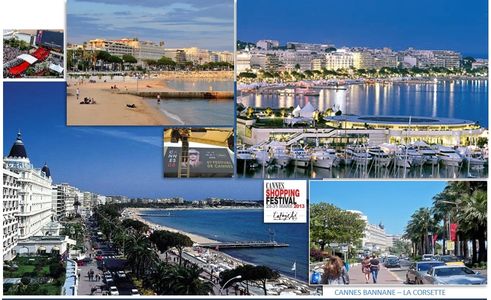

Current investment opportunities includes development properties in Cannes (France), and the Caribbean of Providencia Island (Archipelago of San Andres & Providencia, Colombia). Further locations in the investment pipeline by DV include London, Venice, Paris, Swiss Alps, New York, Boston and Miami.

Exclusive Global Collection of Serviced Private Residences

The Luxury Boutique Hotel experience, reinvented …

Disrupting the niche hospitality property sector. Breaking away from the mould.

A meticulously crafted ultra prime hospitality experience for short and extended stays, across a collection of exceptional properties that you can call your own, in exclusive locations around the globe.

Cannes, France - Boutique Hotel

Luxury boutique hotel property located in the exclusive area of Cannes Banane is a short walk to the beach and the Palais des Festival, between the prominent road of Boulevard de la Croisette that runs along the shore of the Mediterranean Sea and shopping high street of Rue d’Antibes.

Providencia Island, Colombia - Boutique Hotel

Prime site of the sustainable luxury boutique hotel development is located just off the most beautiful beach of this pristine island, overlooking one of the largest live coral reefs in the world spanning 32 km in length and protected by UNESCO World Heritage Centre.